Housing: Forecasting The Ripple Effect

Housing: Forecasting The Ripple Effect

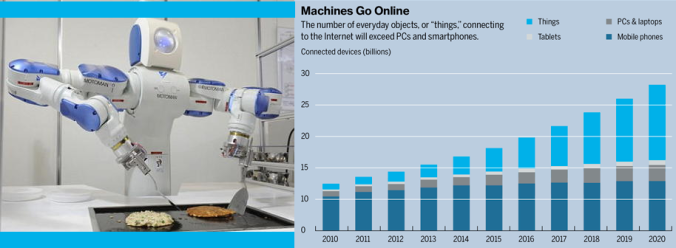

As Americans increasingly choose to live in apartments instead of McMansions, the ripple effect on household goods spending appears to be diminished: “First, less space means less stuff. Second, rental units typically aren’t fitted with high-end appliances and finishes.” Moreover, “value-oriented brands are likely to see the greatest growth [in demand].” It’s not all bad news, however: “Many electronics (like that 70-inch TV set) and furniture pieces are imported. As a result, weaker spending should hold down import growth, which is a plus for GDP growth.” Meanwhile, if you thought the weather impact on GDP in Q1 was confusing, try figuring out it’s impact on Home Depot: “big ticket growth decelerated a decent amount impacted by bad weather as OPE (outdoor power equipment) and roofing categories were affected. This was offset, to some degree, by unprecedented damage from burst pipes and other home improvement jobs needed after the winter.” Speaking of You-can-do-it-We-can-help: “Fifty-three percent of U.S. homeowners say they are remodeling to increase the resale value of their home…Bathrooms and kitchens are the most popular renovation projects again this year…Kitchens continue to receive the highest share of dollars overall with U.S. homeowners spending an average of $26,172 to remodel this space….The study also found that homeowners are ‘doing more with less,’ with 76 percent saying that they retained their home’s existing footprint in their last remodeling project.” Furthermore, houses on the market are getting older. Meanwhile, here are the defining characteristics to keep in mind when targeting the Gen Y consumer. “The only possession Generation Y really covets is technology” has got to sound really good to the companies trying to connect billions of household “Things” to the internet (Fog?). Speaking of which, a robotic butler at Carnegie Mellon University performed in a play this weekend; the robutler’s skills include “finding coffee mugs and moving them into a dishwasher, opening microwave and refrigerator doors and taking a book from a shelf.” Meanwhile, “New York Fed President William Dudley offered his two cents Tuesday on why the housing sector’s contribution to the economy has ‘stalled out’ over the past few quarters”: 1) lending standards are tight (although loan officers say that borrowers with low credit scores are simply not applying for loans), 2) burgeoning student debt is crushing the hopes and dreams of first-time home buyers and 3) cheap homes are not being built.

Caution: Leveraged Buyouts, Reaching For Yield And Illiquid Floating Rate ETFs

The Fed and the OCC told banks last year “to avoid financing leveraged buyouts in most industries that would put debt on a company of more than six times its earnings before interest, taxes, depreciation and amortization, or EBITDA…40% of U.S. private-equity deals this year have used leverage above that six-times ratio (alt) deemed the upper acceptable limit by regulators…that is the highest percentage since the prefinancial-crisis peak of 52% of buyout loans in 2007.” Meanwhile, investors are snatching up new risky mortgage securities from Fannie Mae (alt): “the offering is Fannie’s third sale of so-called risk-sharing certificates that enlist investors to pay for potential defaults on the home loans Fannie guarantees. The riskiest of the securities, linked to loans to home purchasers who paid as little as 3% cash upfront, drew 19 times the bids necessary to complete the sale before yields were cut.” Also, junk grade companies are “paying only 1.5 percentage points more, on average, than firms deemed investment-grade, about the slimmest margin since 2009 and down from a gap of 3 percentage points a year ago…The market is encouraging companies to be ‘more aggressive with their balance sheets,’…’The cost of moving down the credit ratings spectrum is not nearly as high as it once was.’” Meanwhile, “investors have been pulling money out of exchange-traded funds backed by bank loans, once again raising concerns about the ability of lightly traded financial markets to handle a big exodus from ETFs (alt).” Bank loan ETFs are attractive thanks to “the floating interest rates that bank loans offer, which pay investors more as rates rise.” The problem is “loan traders buy and sell loans by passing physical loan documents back and forth. This manual process, just about unheard of in other markets, takes an average of 22 days to complete.” So as interest rates continue to flat-line and investors pull out of their “rising interest rates” bets, the potential for a liquidity squeeze on bank loan ETFs is greater. Meanwhile, here’s an interesting look back at how the S&P 500 has performed in various rate environments: In theory, stocks should feel some downward pressure as interest rates (and the risk-free rate) rise, the simple reason for this being that investors demand a higher rate of return for riskier investments. Taking a look back at how the S&P 500 has performed in years of rising interest rates (1956-59, 60s and 70s) we see that the stock market performed pretty much in line with historical returns (11.6%, 7.7% and 5.9% in those years), however it was high inflation in the 70s which really hurt investors earning sub-7% total returns.