Tail Risks, Equity Premiums And Orientalism

Tail Risks, Equity Premiums And Orientalism

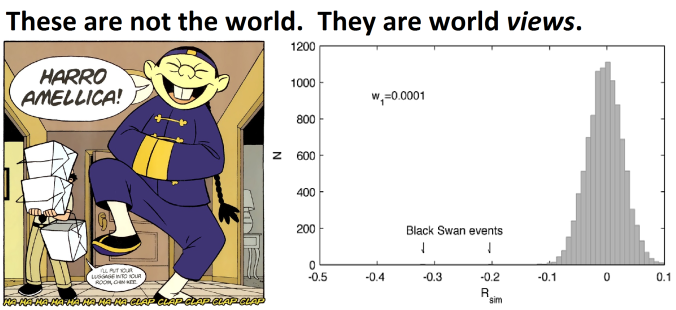

“Has the world sunk into ‘secular stagnation’, with a long future of much lower per capita income growth driven significantly by a chronic deficiency in global demand? Or does weak post-Crisis growth reflect the post-financial crisis phase of a debt supercycle where, after deleveraging and borrowing headwinds subside, expected growth trends might prove higher than simple extrapolations of recent performance might suggest?” Ken Rogoff is going with number 2. “Unlike secular stagnation, the debt supercycle is not forever,” which is basically Ken’s favorite rule of thumb. The whole article is worth a read, but I’d like to highlight an interesting section on tail risk: “small changes in the market perception of tail risks can lead both to significantly lower real risk-free interest rates and a higher equity premium…Indeed, it is not hard to believe that the average global investor changed their general assessment of all types of tail risks after the global financial crisis. The fact that emerging market investors are playing a steadily increasing role in global portfolios also plausibly raises generalised risk perceptions, since of course many of these investors inhabit regions that are still inherently riskier than advanced countries.” Speaking of inherently risky investors: Crazy Facts About China’s Stock Market That Will Make You Think Twice Before Investing. “About two-thirds of new [Chinese] equity investors left school before the age of 15…six percent of new equity investors are illiterate…The Chinese are the world’s most optimistic investors…However, it’s a matter of debate whether the roaring bull is a sign of fundamental strength, or speculation frenzy fueled by enthusiastic mom-and-pop savers and high-school dropouts.” Sure it is. Meanwhile, Hank Paulson debunks 5 myths about China: “I often get asked if China is going to eat our lunch or surpass us…I always say that you can exaggerate China’s strength just as much as you can underestimate its potential…It will get more complicated because China is a formidable competitor in addition to being a partner, but it’s in our interest to work with them.” “The Orient [has] a kind of extrareal, phenomenologically reduced status that puts them out of reach of everyone except the Western expert. From the beginning of Western speculation about the Orient, the one thing the Orient could not do was to represent itself. Evidence of the Orient was credible only after it had passed through and been made firm by the refining fire of the Orientalist’s work.” Back to Ken: “Of course, a rise in tail risks will also initially cause asset prices to drop (as they did in the financial crisis), but then subsequently they will offer a higher rate of return to compensate for risk. All in all, a rise in tail risks seems quite plausible, even if massive central bank intervention sometimes masks the effect in market volatility measures.” Meanwhile, We Traveled Across China And Returned Terrified For The Economy. SOE You’ve Actually Defaulted? And, China Goes Gaga Over Pole Dancing.

Energy: China Is Crushing The Renewable Energy Race

USA: S&P 500 Has Been “Home On The Rangebound” Recently

USA: Re: Earthquakes And Fracking, “Abundance Of Smoking Guns In This Case”

Gross: Trying To Pull A Soros On German Bunds